25 November 2025 – Climate hazards are already costing Asia’s major electricity utilities US$6.3 billion each year. Those costs could grow 33% by 2050 unless global emissions fall and resilience measures are taken.

The findings come from new research released by Asia Investor Group on Climate Change (AIGCC) with primary analysis by MSCI Institute of 2,422 power generation assets across Asia owned by the region’s 11 major energy utilities with policy recommendations from AIGCC.

Beyond climate hazards’ direct financial costs to the utilities, the disruptions to electricity generation will impose billions more in costs and lost revenue across the businesses and homes that need reliable and affordable electricity supply.

Download the full report

Risks from Extreme Weather and Chronic Change

Rising heat and extreme rain are the main chronic risks but tropical cyclones and floods are also likely to disrupt and damage assets.

Coal-fired power plants are particularly exposed to physical climate risks because they rely heavily on water for cooling, making them vulnerable to river low flow and water scarcity.

Coal-fired generators are often located in coastal areas where they face heightened risks from flooding and storm surges.

Additionally, their efficiency drops significantly during extreme heat events, and their rigid infrastructure limits adaptability compared to more flexible technologies like solar or wind.

The analysis showed significant room for action to reduce risks: Of the eight companies disclosing forward-looking adaptation plans, none had disclosed adaptation-related Capex and Opex and only two companies, had disclosed measurable adaptation plans.

Quote From AIGCC CEO Rebecca Mikula-Wright:

“This analysis makes it clear that climate hazards are not a distant threat—they’re already imposing billions in costs on Asia’s energy companies and their customers throughout their markets.

“Every stakeholder, from utilities and policymakers to investors, has the ability and responsibility to act now.

“By embedding resilience into planning and investment decisions, we can protect critical infrastructure, safeguard communities, and ensure reliable energy for decades to come.”

Quote From MSCI Institute Founding Director Linda-Eling Lee:

“Assessing physical risk demands a location-specific lens that distinguishes asset-level vulnerabilities and enables targeted resilience strategies. For owners and operators of critical infrastructure, addressing these localized risks is not only essential for safeguarding long-term value—it’s also critical for ensuring the continuity of energy systems that economies and communities rely on.”

Losses By Company

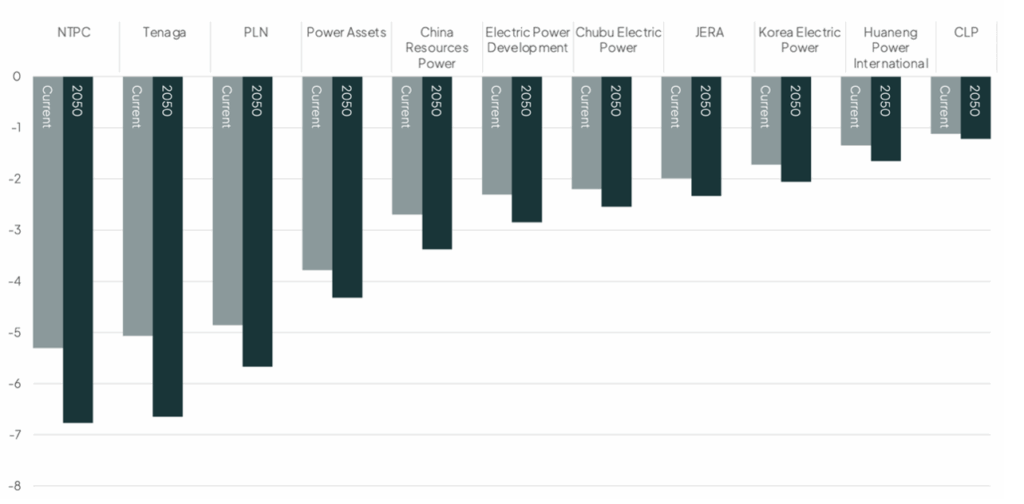

The companies with the worst annual average losses are India’s NTPC, Malaysia’s Tenaga and Indonesia’s PLN.

Average Annual Loss % By Company: Current and 2050

National Losses

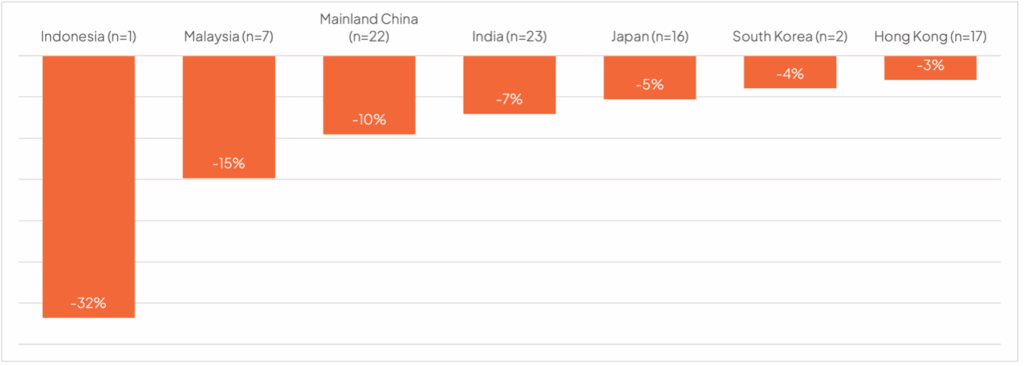

The potential reductions to companies’ collective market capitalisation across countries’ range from 3% to 32% when grouped within jurisdictions.

Physical Capital Value at Risk, Grouped by Country

Actions to Reduce Costs

Despite the current and potential scale of economic damage, there are actions utilities, policymakers and investors can take to manage and reduce the physical risk exposure in this crucial system:

For Utilities

- Strengthen physical risk impact quantification and disclosures

Utilities should conduct forward-looking, asset-level assessments of physical climate risks across both generation and grid assets. These should include clear assumptions, time horizons, and scenario details, along with quantified financial impacts and adaptation measures.

- Engage with policymakers on resilience planning

Utilities should collaborate with national and municipal governments to align infrastructure protection levels, coordinate adaptation investments, and prevent maladaptation. Mapping interdependencies and cascading risks is key.

- Integrate adaptation within transition planning and governance

Boards should oversee how resilience is embedded in decarbonisation strategies. Utilities should align capital allocation with risk assessments and consider cost-benefit analyses of resilience investments.

For Policymakers and Regulators

- Track and enhance corporate climate resilience disclosures

Establish or strengthen requirements for utilities to disclose asset-level risk assessments, financial impact projections, and adaptation measures, aligned with ISSB standards.

- Integrate utility sector risks into national adaptation plans

National climate risk assessments should include utility sector vulnerabilities. Policymakers should define minimum resilience standards for critical infrastructure and coordinate financing strategies.

- Address transboundary and systemic risks through coordination

Use regional platforms (e.g., ASEAN) to facilitate cross-border resilience planning, data sharing, and blended finance mechanisms for infrastructure benefiting multiple jurisdictions.

For Institutional Investors

- Engage on adaptation policy and governance strategies

Investors should promote system-wide adaptation benefits, encourage multi-stakeholder collaboration, and engage boards on resilience oversight.

- Strengthen climate risk disclosures and adaptation implementation

Encourage utilities to improve the granularity and transparency of physical risk assessments, including financial impacts, scenario assumptions, and capex/opex allocations.

- Tailor engagements based on asset and hazard profiles

Investors should assess the rationale behind hazard and asset inclusion/exclusion in risk assessments and evaluate the adequacy of resilience investments relative to exposure.

Read the full paper, Asia’s Powerhouses at Risk: Physical Climate Risk Exposure and Resilience Readiness across Asia’s Electric Utilities, here.

About the Research

Asia’s Powerhouses at Risk: Physical Climate Risk Exposure and Resilience Readiness across Asia’s Electric Utilities, new research jointly published by the Asia Investor Group on Climate Change (AIGCC) and MSCI Institute, assesses physical climate risk exposure and resilience readiness across 11 major Asian electric utilities.

It combines asset-level analysis of 2,422 power generation sites with a review of corporate adaptation plans, highlighting rising financial impacts from climate hazards and outlining actions for utilities, policymakers, and investors to strengthen systemic resilience.

About AIGCC

AIGCC is the leading network of investors in Asia focussing on risks and opportunities in climate and nature – which are key to investors’ fiduciary duty.

Our 80+ members have a combined AUM of $36 trn and have headquarters in 11 markets across the region.

We are a not-for-profit, and our work across finance, business and policy making is underpinned by science, economics, and a deep knowledge of Asian markets and dynamics.

About MSCI Institute

The MSCI Institute is on a mission to advance knowledge that tackles systemic challenges to create long-term value through global capital markets.

The Institute pursues its mission through research, education and events that equip financial institutions, academic researchers, policymakers and NGOs with the insights they need to drive progress. For more information, please visit msci-institute.com.